VLRM Markets will utilise ‘The Bridge’ technology platform to establish a licensed and regulated stock exchange and CSD, for the issuance and trading of tokenised securities and digital assets. In addition, we will seek to open Real World Asset (RWA) marketplaces, to enable the primary issuance and bulletin board based secondary trading of tokenised assets, including investment funds, private companies, gold, art, luxury goods, royalties.

VLRM Technology is focused on the delivery of innovative full stack technology solutions for the capital markets, in support of the tokenisation of primary and secondary trading in public and private markets.

VLRM is finalising V1 of its proprietary Digital Financial Market Infrastructure (DFMI) platform, known as ‘The Bridge’, due to launch Q4 2024 available as a white label solution.

VLRM Capital is an investment vehicle managing both VLRM’s own funds and third party capital. The VLRM strategy for growth is centred around principal trading in securities and crypto, alongside yield farming and node operations for 3rd party blockchains.

The fuel that drives the VLRM Network.

GATE token is the utility token that is used within the VLRM ecosystem for Fees, Staking, Burning And Governance. It underpins our settlement of fees within the VLRM network while supporting the adoption of digital assets and digital securities.

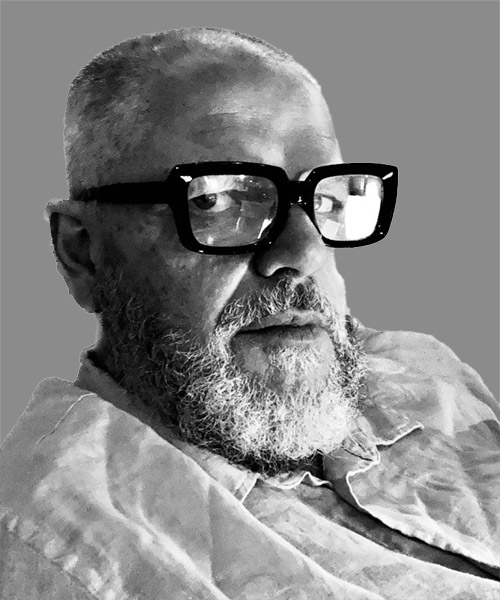

VLRM CHAIRMAN – JAMES FORMOLLI

“I have worked in a range of industries, and seen many breakthroughs and innovative ideas within each of them over the years. VLRM however, is offering to transform global finance in such a far reaching and impactful way that it is a truly exciting venture to be a part of.

We have the perfect team to execute our goals and are poised to make a real impact to the infrastructure of legacy finance, as we deliver new marketplaced supported by our cutting-edge full stack technology solutions.”

- James Formolli, Chairman Valereum plc

OUR VALUES

To realise its bold vision efficiently, VLRM is committed to working according to 3 values:

INTEGRITY

RESPECT

REPUTATION

VLRM ROADMAP

Planning and research commences on the Digital Financial Market Infrastructure (DFMI) platform.

Work commences on sourcing relevant technology vendors, developers and expertise to scope out the work required to build the DFMI platform.

Commencement of work on the DFMI platform, with further networking of partnerships and suppliers for the function and growth of the platform.

Demonstration of ‘Version 1’ of the DFMI platform rolled out, followed by further testing and construction.

VLRM Capital to set up trading vehicles and VLRM Markets to begin license applications for marketplaces and exchanges.

VLRM Capital to start trading securities and cryptocurrencies, with VLRM markets submitting license applications when applicable.

VLRM Markets target to launch Real World Assets (RWA) markets, VLRM Capital will expand node operations and yield farming.

VLRM Technology ‘The Bridge’ Digital FMI platform Phase 1 launch, VLRM Markets will also launch the digital V-Wallet and VLRM Capital to acquire external assets under management (AUM).

VLRM Technology to rollout Phase 2 of ‘The Bridge’ Digital FMI platform.

VLRM Technology to rollout Phase 3 of ‘The Bridge’ Digital FMI platform.

VLRM Technology to rollout Phase 4 of ‘The Bridge’ Digital FMI platform